Frequently Asked Questions

What are shared equity products (SEPs)?

- SEPs are a new form of home financing based on equity rather than debt. These products are also commonly referred to as home equity investments, home equity agreements, and shared appreciation agreements.

- SEPs allow homeowners to sell the right to a portion of their home’s future value to an investor in exchange for an upfront lump sum payment. SEPs have no interest rate, no ongoing payments of principal and interest, and no absolute obligation to repay the investment amount. As such, SEPs are distinct from mortgage loans, home equity lines of credit (HELOCs), and reverse mortgages.

How do SEPs impact homeowners and the broader economy?

- Financial Stability: SEPs do not require monthly payments or interest, which can be a significant relief during times of high mortgage interest rates or economic uncertainty.

- Economic Resilience: SEPs provide cash and liquidity without monthly payments, helping homeowners address financial needs, manage stressful situations, and maintain their homes, which supports the economy.

- No Debt Incurred: Total household debt in the United States now exceeds $17 trillion dollars and is at or near an all-time high. For millions of homeowners that have a need for cash, additional debt may not be the best solution.

How do homeowners typically use the money?

- SEPs help homeowners with substantial equity in their properties meet their financial objectives without taking on additional debt and monthly payments. Securing financing with no periodic payments is very valuable, as it gives the homeowner the opportunity to prioritize other financial obligations.

- Homeowners typically use their SEP proceeds to meet various financial needs. These may include eliminating debt, paying for home renovations, financing their children’s education, covering medical expenses, starting a small business or supplementing retirement income.

Who can qualify for SEPs?

- A socially and economically diverse group of homeowners qualify for SEPs. Because SEPs are underwritten as an investment in property as opposed to an obligation that involves the consumer’s ability to make recurring payments, SEPs are available to a broader range of homeowners, including consumers with less-than-perfect credit, small business owners, retirees, and those without steady income.

- SEPs are particularly useful in situations where a homeowner cannot qualify for a home loan or would prefer to obtain financing without monthly payments. Importantly, the value of obtaining financing with no periodic payments is substantial, freeing up existing cash flows to create much-needed breathing room to focus on other financial priorities.

How do SEPs work?

- SEPs are contracts (typically structured as an option or other type of investment plan) where homeowners sell the right to receive a percentage interest in the future value of their home in exchange for an upfront lump sum payment. The homeowner may repurchase the investor’s right at any time during the term of the contract, and there are never any prepayment penalties.

- During the term of the SEP, the homeowner remains the sole owner of the property and maintains it as they normally would. The homeowner is responsible for ongoing housing expenses, including mortgage loan payments, property taxes, property insurance, HOA dues, and maintenance.

- The homeowner makes no monthly payments during the term of the SEP. SEP terms are typically 10 or 30 years, depending on the provider.

- The SEP investor will have a lien on the property to protect its investment, most often in second lien position behind a pre-existing mortgage loan. The lien is released upon settlement.

- The investor receives its percentage interest in the home only upon the occurrence of a specified event, which generally includes a sale of the property, the expiration of the SEP’s term, or the homeowner’s repurchase of the investor’s interest in the property. These events are referred to as “settlement events.”

- The amount is based on the value of the property at that time. In addition, all Coalition for Home Equity Partnership (CHEP) member products are subject to an annualized cost cap.

What happens if the homeowner fails to settle at the end of the term?

- Upon the expiration of a SEP, homeowners who do not want to sell their properties and do not have cash in hand to settle the SEP may be able to qualify for a mortgage loan and use the proceeds to settle the investment. Others may choose to refinance into another SEP. Homeowners experiencing a temporary hardship may also be able to reach an agreement with the investor to extend the term of the SEP.

- If none of the above options is available, the investor may exercise its contractual rights to acquire its percentage interest in the property and then work with the homeowner to sell the property. Where a homeowner refuses to work towards an orderly sale of the property, foreclosure may be pursued as a last resort.

- It is important to understand that a SEP investor working with the homeowner to sell the property is very different from foreclosure by a mortgage lender. SEP investors and homeowners share an interest in maximizing the property’s sale price, because a decrease in property value affects both parties’ financial outcomes. Additionally, SEPs are non-recourse, so the homeowner is not liable if the amount the investor receives at settlement is less than the amount they are entitled to under the contract.

- In contrast, in a mortgage foreclosure, the lender’s priority is simply to recover the unpaid loan balance, interest, fees, and penalties—not to maximize the property’s sale price. This often results in a distressed sale below market value (which can wipe out the homeowner’s equity), and the homeowner is still responsible for any remaining debt if the sale proceeds fall short.

What are the risks of a SEP?

- There is shared risk and reward for the homeowner and the SEP investor, because settlement amount will be based on the future value of the property, which is uncertain. In general, if the home value increases, the homeowner will pay a higher return to the investor, and if it decreases, the homeowner will pay less. In certain circumstances the investor may incur a loss or receive less than the amount they are entitled to under the contract, but the investor will have no recourse to the homeowner.

- Homeowners also need to be aware of the risk of losing their home if they do not settle the SEP by the end of the term. Homeowners are best served by having a settlement strategy when they enter into a SEP. For some homeowners, that strategy may entail the sale of the property during or at the conclusion of the SEP. For other homeowners, settling their SEP may include using proceeds from a cashout mortgage refinance transaction or a replacement SEP or using available cash on hand.

- Investors bear numerous risks in a SEP. If the value of the property significantly declines, the investor may not recoup the initial investment amount. This may occur for many reasons, including a general decline in the housing market, poor maintenance of the property, environmental issues, or localized issues affecting a particular property. Also, the SEP investor is typically in a junior lien position and the homeowner may default on the mortgage loan. In a situation where the mortgage lender is foreclosing on the property, the SEP investor may lose some or all of its invested capital if the sale price for the foreclosure does not cover both the amount owed to the foreclosing mortgage lender and the investment amount originally paid to the homeowner by the SEP investor. Under those circumstances, the SEP investor will take a loss and have no recourse to the homeowner.

What are the different models of SEP?

SEPs generally follow one of two models: “share of value” or “share of appreciation.”

- Under the “share of value” model, the investor provides a lump sum of cash in exchange for a share in the future value of the property. The amount of the investor’s share is generally a multiple of the initial amount invested. The multiple varies but typically ranges from 1.5x to 2.0x. For example, an investor may provide a payment equal to 10% of the current value of the property in exchange for the right to acquire 20% of the value of the property when the SEP is settled. This construct provides a measure of risk protection for the investor.

- Under the “share of appreciation” model, the investor provides a lump sum of cash in exchange for a percentage of the home’s future appreciation. At the time of settlement, the investor’s interest in the property is equal to the investment amount plus an agreed upon percentage of the appreciation that has occurred since the investment was made. For example, an investor may provide payment equal to 10% of the current value of the property in exchange for the initial investment amount plus 35% of the amount that the property has appreciated. The starting value of the property for purposes of measuring appreciation is often discounted to provide a measure of risk protection for the investor.

Is the use of a multiple or discounting unfair or problematic?

- Provided that the terms of the SEP are clearly disclosed to consumers, there is nothing inherently unfair or problematic about the use of a multiple (in the “share of value” model) or discounting the starting value of a property (in the “share of appreciation” model). These practices are simply tools to price the investment, like how interest rates (and discount points or interest rate buydowns) are used for loans, and to help compensate investors for the risk they’re assuming by providing funds to consumers without any investment return for up to 30 years.

- Just as with loans, consumers should be protected by clear disclosures that enable them to understand how the SEP product works and annualized cost caps to prevent excessive outcomes. All CHEP members provide substantial disclosures that enable consumers to understand these features and have implemented annualized cost caps. If these protections are in place, the use of a multiple or discounting is not unfair or problematic.

Do SEPs have a cost cap?

- All SEPs offered by CHEP members include a cost cap that is based on annualized cost. Annualized cost is not the same as an interest rate. Instead, it measures the cost of funds over a given period where there is only a single settlement payment, stated as an annual rate. For example, if someone receives a payment of $50,000 and two years later makes a payment of $60,000, the annualized cost would be 9.54%. Most SEPs currently include an annualized cost cap of 18% to 20%.

- Because of how most SEPs are structured, settlements in the early years of a SEP will likely result in the cost cap being hit. After the first few years that a SEP has been in place, the annualized cost cap will only be reached in cases of very high home price appreciation.

Is the annualized cost cap the same thing as an interest rate?

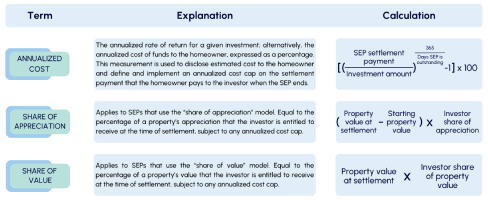

- It is important not to conflate the different percentages used in SEP transactions with interest rates. There are no interest rates involved in SEPs. The key terms are set out below for reference:

How do SEPs differ from traditional financing options?

- Unlike traditional home financing products, SEPs do not require monthly payments, and they typically have more flexible eligibility requirements to enable homeowners to access the equity they have built in their homes. In addition, unlike most home loans, homeowners are not personally liable if the amount the investor receives at settlement is less than the amount they are entitled to under the contract.

- While SEPs are equity-based products, traditional home financing products such as mortgage loans or HELOCs are debt. Debt financing products generally involve an interest rate, ongoing payments of principal and interest, and an absolute obligation to repay the principal advanced to the homeowner. If the property declines in value and the loan is “underwater,” or the homeowner fails to make the scheduled payments, the homeowner is still personally obligated to repay the lender in full pursuant to the terms of a promissory note.

Are SEPs mortgage loans?

- No. SEPs are not a form of credit or mortgage loans. Rather than deferring the payment of debt, SEPs are purchase transactions in which the investor buys the right to acquire a future percentage of a property’s value or a fractional interest in the property. SEPs are generally structured option contracts, forward sales or other forms of investment plans in which the investor risks the loss of the amount they invested without recourse to the homeowner. Courts have affirmed SEPs are not loans.

- SEPs are structurally distinct from loans and best regulated separately. Mortgage lending regulations typically assume a loan with a stated interest rate and predetermined scheduled payments of a principal and interest. As a result, many mortgage regulations are incompatible with the features of SEPs.

- As just one example, mortgage loan disclosure requirements are built around the concept of an annual percentage rate (APR) that is stated at the time the transaction is entered. These disclosure requirements cannot be met for an equity-based product, because annualized cost will vary depending on when the investment is settled and the property value at the time of settlement. Therefore, the actual annualized cost of a SEP will only be known at the time of settlement. Forcing SEP originators to disclose costs using existing APR requirements would give consumers an incomplete and incorrect understanding of the transaction and create confusion.

- There are numerous other incompatibilities that would arise from applying mortgage regulations to the SEP product.

- While some states have passed legislation defining SEPs as mortgage loans or otherwise taken the position that SEPs should be regulated as mortgage loans as a matter of state law, this has occurred in only a few states. As a general matter, the regulators in those states understand that certain existing mortgage regulations are incompatible with SEPs, and they have indicated their intention to work with the SEP industry to take steps to address such incompatibilities.

How do the costs of SEPs compare to the costs of mortgage loans?

- Cost comparisons between mortgage loans and SEPs are useful but must be qualified and properly understood. Depending on the length that an investment is held and the changes in home values during that period, the annualized cost of the SEP could be higher or lower than the interest rate associated with a mortgage loan of comparable duration. Importantly, regardless of whether the annualized cost is higher or lower than the interest rate on a mortgage loan, the homeowner has the use of the funds for the entire term without any required monthly payments. This is an extremely valuable and fundamental feature of the SEP product that provides flexibility and peace of mind, particularly in times of economic uncertainty. In these circumstances, the increased cash flow that SEPs enable is a uniquely valuable feature that most loans cannot match.

- Many consumers considering a SEP are often also considering high-cost debt options like credit cards and personal loans to fund their capital needs. In most cases the annualized cost of the SEP will be significantly less than the interest rate on these other products.

What regulation does CHEP support?

- Licensure and oversight by financial regulators;

- Standardized disclosures that enable consumers to understand how the product operates and compare the cost of SEPs to other financing options;

- Annualized cost caps; and

- Minimum underwriting standards that help homeowners preserve an equity stake in their property.